Due Date to File Form W-2 for 2023 Tax Year

Provide Recipient Copies

January 31st, 2024

Paper Filing Deadline

January 31st, 2024

E-Filing Deadline

January 31st, 2024

Note: If the deadline falls on a weekend or federal holiday, the next business day is the deadline.

File your Form W-2 on time and avoid late filing penalties

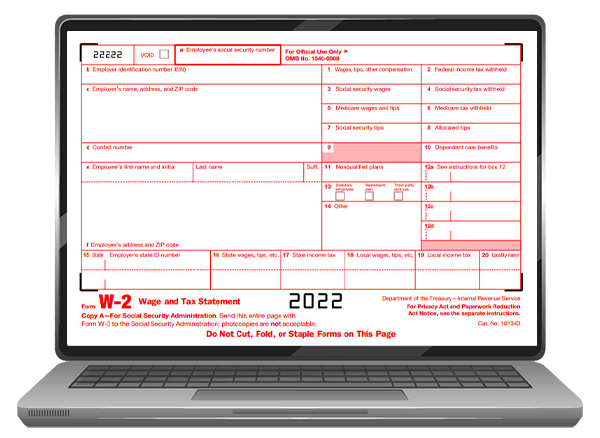

What are the Information Required to

E-file Form W-2?

- Employer Details: Name, EIN, Address, and Contact Information

- Employee Details: Name, SSN, Address, and Contact Information

- Federal Details: Federal Wage & Tax Information

- State Details: State Wage & Tax Information

If the above information is readily available, start filing your W-2 returns with us.

About efilew2.net

Our Cloud based software simplifies the filing of W2 Form. As we are an authorized provider, we help out to e-file Form W-2 with the SSA & State in a timely manner and your Form W-3 gets generated automatically in our system based on the information that you have provided. After you have transmitted successfully with our software, we will print & postal mail the W2 copies to your employees On-time. If you make any mistake on your previously filed return, it is simple now to correct the return with us.

E-filing Form W-2 Online with our Software will save you time, and our expert support team is available to help you all the time.

Visit https://www.taxbandits.com/w2-forms/efile-w2-form-online/ to know more about our software.

Efilew2.net Features

Form W-2 State Filings is also supported

Supports Form W-2 Corrections

Form W-3 gets generated automatically

Receive the status of filing within minutes

TIN Matching helps you out by validating TIN errors with SSA

Postal Mail the W-2 copies to your Employees

Access your forms any time and anywhere

All your details are kept safe

File Multiple Forms all at the same time

Online Access Portal helps your employees to View or Download the W-2 copies

Extend your software with TaxBandits IRS E-file API Integration

TaxBandits API is built with the lightweight REST architecture. To post any data requests, our API uses HTTP requests. All requests, response bodies, and error codes are encoded in JSON by this API.

Get access to an exclusive sandbox environment where they can test the application with live characteristics. The API validates each request received and grants additional API access using authentication keys.

- E-file Payroll and Employment forms to the IRS

- TaxBandits Real-Time Updates

- Postal Mailing of Recipient Copies

- Request Vendors to Complete W-9

Use TaxBandits APIs to e-file Form W-2, 941, 1099, and other forms directly to the IRS/SSA.

How to e-file W-2 Form?

E-filing W-2 Forms doesn't have to be a hassle! Just use the following steps to instantly complete your form with our W-2 reporting software.

Step 1:

Create your free account now.Step 2:

Enter your business details such as name, EIN, address and contact information.Step 3:

Enter your employee information such as name, SSN, contact information, and address.Step 4:

Enter the wage amounts and tax withholdings for each employee.Step 5:

Finally, review your information and transmit it directly to the SSA.

The information entered with us will be safe and secure.

W-2 Form Penalties

You are required to file Form W-2 by the deadline or you will be subject to penalties. The IRS has increased the late penalties on Form W-2 for the tax year 2022. If you fail to file within 30 days after the deadline you will be penalized $50 per W-2 form. Then if it is more than 30 days, if you still haven't filed the penalty increases to $110 per W-2 form with a maximum fine of $1,713,000 per year and $571,000 for small businesses. Learn More

Get A Form W-2 Extension

If you need more time to file Form W-2 onine for the reason such as, if your business records were affected during a catastrophe or other similar circumstances., you can submit a form extension by e-filing Form 8809. The request for extension can be made through a letter to the IRS between January 01, 2022 to January 31st, 2022.

Form W-2 Mailing Address

If you paper file Form W-2, then mail your W-2 paper copies to the SSA. For more information in the Form W-2 mailing address,

visit, https://www.taxbandits.com/w2-forms/where-to-mail-form-w2/

Helpful Resources

What is Form W-2?

Form W-2 Due date

Form W-2 Instructions

Form W-2 Penalties

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.

Contact Us

We are ready to assist you! Contact our US-based support team located in Rock Hill, South Carolina by phone, email.